Fourth Quarter Highlights

- U.S. Treasury (UST) yields fell sharply during the fourth quarter, responding to both favorable inflation data and dovish messaging from the Federal Reserve (Fed).

- The Federal Open Market Committee (FOMC) held rates steady throughout the quarter, maintaining the target fed funds rate range at 5.25%-5.50%. However, post-meeting statements and press conferences revealed more dovish messaging.

- The Committee lowered its median 2024 year-end fed funds rate forecast to 4.625%, down 50 basis points (bps) from its September projection.

- Despite a strong third quarter GDP report, economic growth appears to have decelerated. However, consumers remain resilient, lessening fears of a recession.

- Labor markets showed continued strength, with the unemployment rate remaining in the 3.5%-3.8% range throughout the second half of 2023. Additionally, year-over-year wage growth continued to exceed 4%, indicating tight labor markets.

- Following the December FOMC meeting, market expectations for rate cuts accelerated, pricing in six cuts for the balance of 2024, far exceeding the FOMC projection for three cuts.

- Risk premiums across investment grade sectors compressed, resulting in uniformly positive excess returns for the quarter and full year.

- Relative value opportunities appear somewhat limited within corporate credit. While Financials and shorter-dated maturities are attractive on a historical basis, we believe Structured Product sector valuations are more compelling.

Duration Positioning

Near Neutral

Modestly underweight duration by approximately 2%-3% across strategies.

Credit Sector

Modestly Overweight

Overweight Financials, Utilities and select Industrial sectors, primarily within Energy-related sub-sectors. Underweight Healthcare,

Pharmaceuticals and Non-Corporate Credit.

Structured Products

Overweight

Maintained overweights in

Asset-backed Securities (ABS) across short and intermediate strategies. Remain overweight in Agency Mortgage-backed Securities (MBS) across styles.

Remarkable Rally Saves the Year

After a steep rise in yields during the summer and into early fall, fixed income investors braced for a third consecutive calendar year of negative returns, as measured by the Bloomberg Aggregate Index. By mid-October, yields reached new cycle highs for a variety of reasons, namely hawkish Fed rhetoric, elevated inflation and sobering fiscal deficit forecasts.

Rising rates led to a considerable tightening of financial conditions, particularly as the real yield on 10-year U.S. Treasury Inflation-Protected Securities approached 2.5%. In response, some FOMC participants indicated that evolving market sentiment could supplant the need for additional fed fund hikes. Commentary from Chair Jerome Powell following the November FOMC meeting reinforced this rhetoric, which fixed income markets interpreted as a dovish pivot.

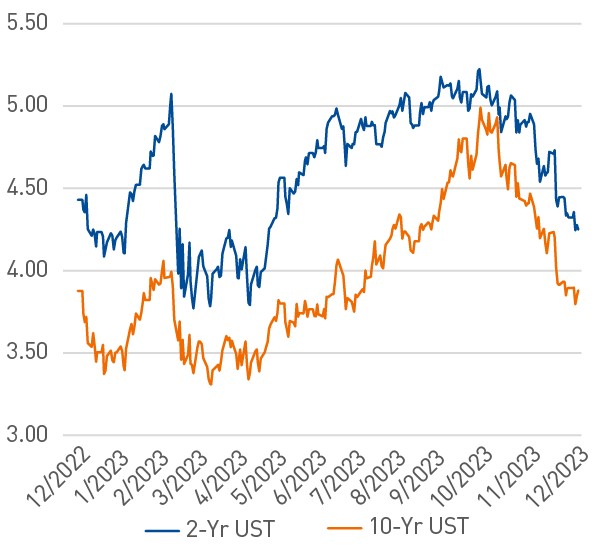

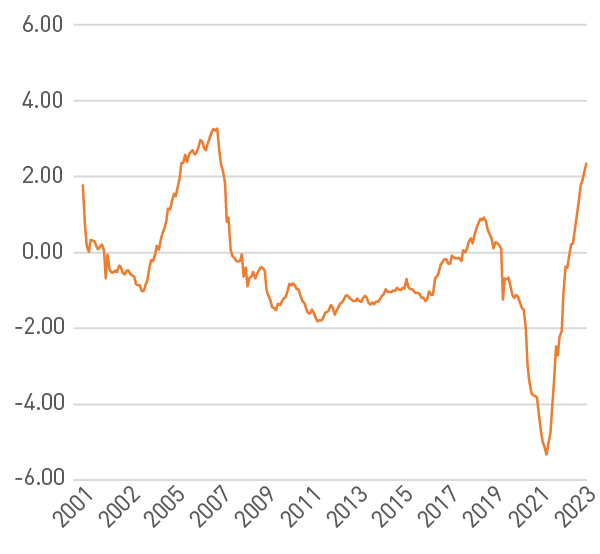

In the following weeks, and again at the December FOMC meeting, Chair Powell and his Fed colleagues did little to push back against this narrative, providing a catalyst for interest rates to fall further. Softer inflation data during November and December provided additional fuel for the rally. Rates ultimately dropped 70 bps across the yield curve for the fourth quarter. Remarkably, this left yields on USTs with maturities of 2 years and longer, mostly lower year over year (Figure 1).

Figure 1. UST Yields

USTs ended the year near where they started

As of 12/31/2023. Source: FactSet®. FactSet® is a registered trademark of FactSet Systems Inc. and its affiliates.

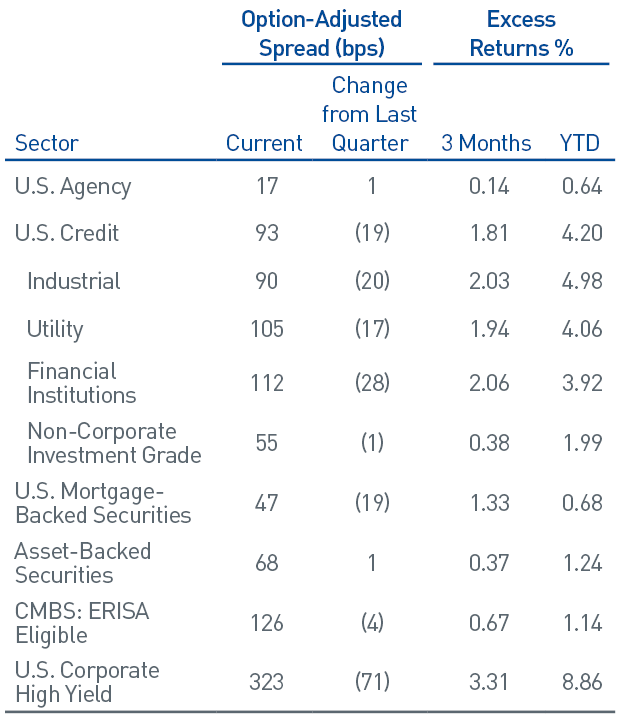

The significant decrease in rates led to an impressive 6.82% quarterly return for the Aggregate index, bringing the 2023 calendar year return to 5.53%. Positive total returns were not just attributed to the UST rally, as all investment grade sectors had positive excess returns as well. Investment grade corporate credit spreads compressed 19 bps, generating excess returns of 1.81%, while high yield produced 3.31% (Figure 2). MBS, which had languished for much of the year, generated excess returns of 1.33%, helping salvage year-to-date performance for the sector.

Figure 2. Sector Comparison

The year-end rally produced positive excess returns across the board

As of 12/31/2023. Source: Bloomberg L.P.

The Fed — Mission Accomplished?

Leading up to the December FOMC meeting, the consensus view among market prognosticators was that the Fed had completed its hiking campaign. Instead, attention shifted to when rate cuts might begin. Updated FOMC projections showing a 4.625% policy rate for the end of 2024 — implying 75 bps in cuts — only reinforced this view. Markets immediately latched onto this dovish projection and rallied sharply over the ensuing weeks.

By the end of December, the fed fund futures market implied expectations for more than six cuts in 2024, far outpacing the Fed’s projections. Rather than address this divide, Fed comments have largely focused on the current restrictive level of monetary policy and expectations for further progress on inflation. The December FOMC meeting minutes echoed this theme. Members expressed concerns that keeping the policy rate too high, for too long poses risks given the lagged effect of policy tightening. While recent inflation trends suggest Fed hikes are likely finished, given the persistent strength of labor markets and consumer spending, we believe the implied 150 bps of cuts seem like a stretch, absent a noticeable slowdown in economic activity.

Within the December FOMC minutes, initial discussions about when to slow the pace of the Fed’s balance sheet reduction program (quantitative tightening, QT) were noteworthy. It makes sense, in our view, for the Fed to begin deliberating this topic well ahead of time given officials’ strong desire for transparency. We expect this to be a closely followed topic in future FOMC meetings. Furthermore, it will be important to differentiate if the rationale for slowing QT is policy driven, or more related to technical factors that govern how markets function. Balances in the Fed’s reverse repo program — which held at more than $2 trillion for much of the first half of 2023 — have fallen considerably to around $700 billion. As liquidity drains from the system, the Fed is becoming more attentive to potential funding disruptions and may focus on the balance sheet before calibrating the target fed funds rate.

As the Fed seeks to balance economic growth and maximum employment against its longer-term inflation objective, easing financial conditions and the recent rebound in risk assets may counter its goals. A more favorable market backdrop could lead to a reacceleration of economic growth that stifles progress on price stability. Worse, from the market’s perspective, it could lead to a more moderate approach to rate cuts during 2024. We expect the Fed to consider the surprising resiliency of both consumers and corporations, despite increased borrowing costs, as it evaluates the success of its tightening campaign.

Valuations Stretched after Risk-on Quarter

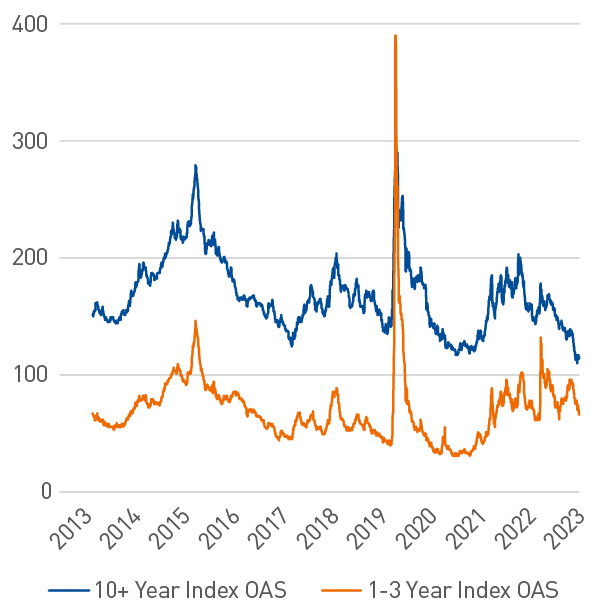

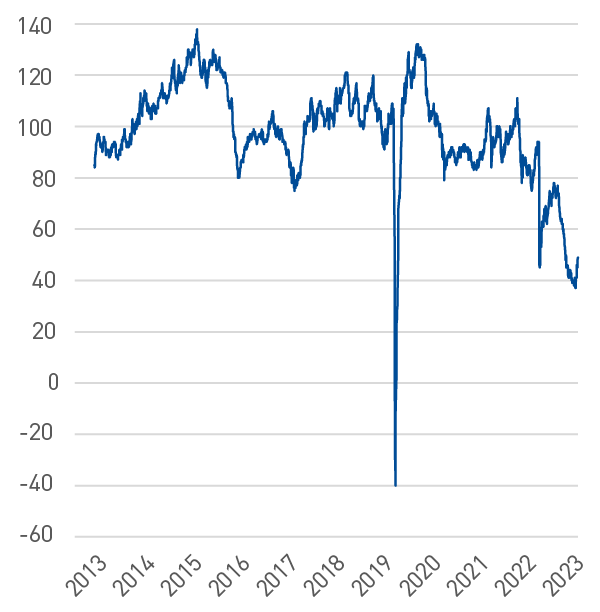

The rally across both USTs and risk assets was dramatic during the final two months of the year, resulting in stretched valuations. Long-duration credit stands out, as spreads have substantially outperformed other maturity segments for much of the past year. In fact, more recent relative valuations are in stark contrast with their historical relationship to shorter-duration credit (Figures 3 & 4).

Figure 3. Bloomberg U.S. Corporate 10+ Year Index OAS vs. Bloomberg U.S. Corporate 1-3 Year Index OAS, bps

Longer duration credit has more favorable valuations relative to shorter duration, breaking from history

Figure 4. Long Corporate Index OAS - Short Corporate Index OAS, bps

As of 12/31/2023 Source: Bloomberg L.P.

Elevated interest rate volatility and challenging technicals weighed heavily on the MBS market for much of 2023. Despite underperforming credit through October, mortgage securities enjoyed a similarly robust rally in November and December, allowing the sector to generate positive excess returns for the year. Valuations remain attractive on a historical basis, but we are mindful that as the Fed continues to reduce its influence in the MBS market, episodic volatility will likely persist. Given the liquid nature of the sector, we expect to continue our tactical approach toward portfolio positioning.

Keep Calm and Carry On

Looking at our current risk positioning through a contribution-to-duration lens, we are close to neutral across most Broad Market strategies. Overall, we maintain a defensive posture, as the symmetry of return in risk assets remains slightly unbalanced.

There are a number of risk factors incorporated into our outlook. While Fed policy will likely ease this year, lower inflation is supporting a significantly higher real fed funds rate than what the economy has encountered in over a decade (Figure 5). Additionally, the Fed’s “higher-for-longer” mantra is continuing to pressure refinancing costs for corporate debt. Since mid-2022, the yield-to-worst on the Bloomberg Credit Index has exceeded the weighted average coupon by more than 100 bps. Finally, geopolitical risks remain elevated, with ongoing conflict in Eastern Europe, rising tensions in both the Middle East and Asia, and the upcoming U.S. presidential election.

Figure 5. Effective Fed Funds Rate - Core Personal Consumption Expenditure (%)

The “real fed funds rate” is at the highest level in over a decade

As of 12/31/2023. Source: Bloomberg L.P.

Given increasing conviction that the Fed’s next move will be interest rate cuts, we have fielded a number of inquiries from clients regarding the potential for extending maturity profiles. As money market fund assets have exploded in size — currently pushing $6 trillion in the United States — there is likely a meaningful portion of this cash pool that could be redeployed into longer-duration strategies, should the yield curve steepen in response to rate cuts. We continue to believe investors with elevated cash balances would be well compensated to begin that transition now (Read more in our recent publication, Year of the Duration Dragon).

Even if market expectations for cuts are dialed back, attractive purchase yields provide significant cushion to investors, particularly in short-duration strategies. As we have noted in several pieces over the last year, based on our historical analysis, starting yield provides a good framework for understanding potential forward returns. This dynamic has proved relevant over recent periods as well. For example, the Aggregate index ended 2022 with a yield-to-worst of 4.68% and returned more than 5% in 2023. The index yield-to-worst began the new year around 4.5%, providing both carry that exceeds inflation and the potential for total return as Fed policy evolves over the course of the year.

Important Disclosures

Indices

The Bloomberg US Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency).

The Bloomberg US Aggregate Corporate Index represents the total return measure of the corporates portion of the Barclays U.S. Aggregate Index.

The Bloomberg U.S. Corporate 10+ Year Index measures the performance of the investment grade, USD-denominated, fixed-rate, taxable corporate bond market securities with maturities of 10 years and greater.

The Bloomberg U.S. Corporate 1-3 Year Index measures the performance of investment grade securities which are selected by a market value process with maturity of 1-3 years. The index includes publicly issued USD-denominated corporate issues that have a remaining maturity of greater than or equal to 1 year and less than 3 years, are rated investment grade (must be Baa3/BBB-or higher using the middle rating of Moody’s Investor Service, Inc., Standard & Poor’s, and Fitch Rating), and have $250 million or more of outstanding face value.

The Bloomberg US Credit Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate and government related bond markets. It is composed of the US Corporate Index and a non-corporate component that includes foreign agencies, sovereigns, supranationals and local authorities.

The Bloomberg U.S. Corporate High Yield Index measures the performance of USD-denominated, non-investment grade, fixed rate, taxable corporate bonds, including corporate bonds, fixed-rate bullet, putable, and callable bonds, SEC Rule 144A securities, Original issue zeroes, Pay-in-kind (PIK) bonds, Fixed-rate and fixed to-floating capital securities.

The Core Personal Consumption Expenditure price index measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends.

BLOOMBERG® and the Bloomberg indices are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by PNC Capital Advisors LLC. (PCA). Bloomberg is not affiliated with PCA, and Bloomberg does not approve, endorse, review, or recommend this material. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the information herein.

This publication is for informational purposes only. Information contained herein is believed to be accurate, but has not been verified and cannot be guaranteed. Opinions represented are not intended as an offer or solicitation with respect to the purchase or sale of any security and are subject to change without notice. Statements in this material should not be considered investment advice or a forecast or guarantee of future results. To the extent specific securities are referenced herein, they have been selected on an objective basis to illustrate the views expressed in the commentary. Such references do not include all material information about such securities, including risks, and are not intended to be recommendations to take any action with respect to such securities. The securities identified do not represent all of the securities purchased, sold or recommended and it should not be assumed that any listed securities were or will prove to be profitable. Past performance is no guarantee of future results.

PNC Capital Advisors, LLC claims compliance with the Global Investment Performance Standards (GIPS®). A list of composite descriptions for PNC Capital Advisors, LLC and/or a presentation that complies with the GIPS® standards are available upon request.

PNC Capital Advisors, LLC is a wholly-owned subsidiary of PNC Bank N.A. and an indirect subsidiary of The PNC Financial Services Group, Inc. serving institutional clients. PNC Capital Advisors’ strategies and the investment risks and advisory fees associated with each strategy can be found within Part 2A of the firm’s Form ADV, which is available at https://pnccapitaladvisors.com.

©2024 The PNC Financial Services Group, Inc. All rights reserved.

FOR INSTITUTIONAL USE ONLY

INVESTMENTS: NOT FDIC INSURED-NO BANK GUARANTEE – MAY LOSE VALUE